Tax filing & preparation support

Collects and organizes tax documents, ensuring all required information is accurately prepared and submitted on time for smooth and compliant tax filing.

Spend more time growing—let us handle the rest.

Our accounting and finance virtual assistants help manage bookkeeping, invoicing, financial reporting, client communications, and appointment scheduling. They ensure your financial operations are accurate and efficient, allowing you to focus on strategic planning and growth.

Collects and organizes tax documents, ensuring all required information is accurately prepared and submitted on time for smooth and compliant tax filing.

Supports the preparation of detailed financial reports, ensuring accurate data collection and analysis to provide valuable insights into business performance and financial health.

Ensures steady cash flow by issuing accurate invoices, tracking payments, sending reminders, and following up with clients to resolve any outstanding balances promptly.

Manages payroll processing by calculating wages, deductions, and reimbursements, ensuring employees are paid accurately and on time while maintaining compliance with regulations.

Tracks income and expenses, ensuring accurate financial records for informed decision-making and compliance with accounting standards.

Handles real estate finances by managing invoices, payments, and expense tracking, ensuring accurate records and streamlined transactions for property managers and high-volume agents

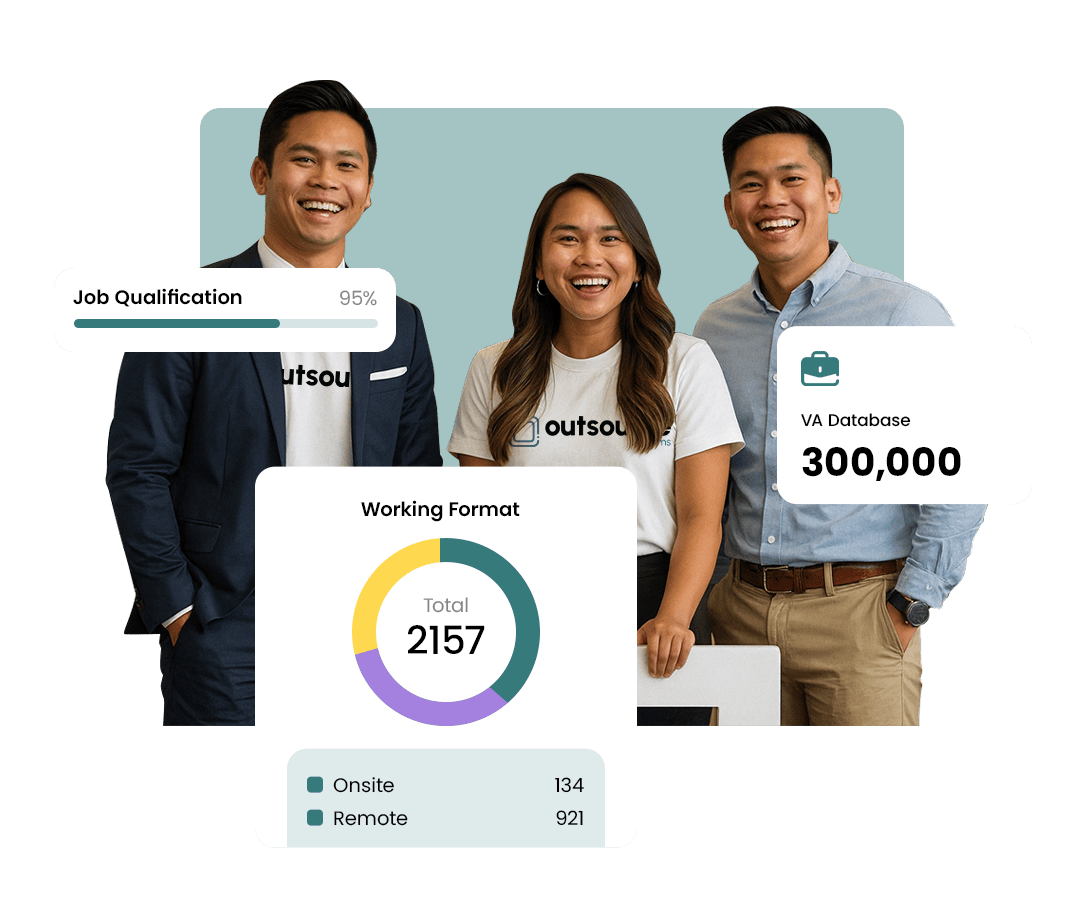

Work only with the top 1% of VAs in the Philippines, experienced in accounting tasks.

Test your accounting VA free for one week, with instant replacement if needed.

We cover 10 paid leave days yearly so your financial tasks never stop.

We manage HR and reviews to keep your VA efficient and compliant.

Get one simple invoice each month covering payroll, timesheets, and compliance.

Pay only for hours worked, with clear timesheet updates and predictable costs.

EXCELLENTTrustindex verifies that the original source of the review is Google. I needed to fill a role urgently and found Outsource Teams. The process was seamless, fast, and very personalised to my needs. I was pleasantly surprised of the quality of hire given the tight timeframe. I’ll definitely be using them again and would happily recommend them.Posted onTrustindex verifies that the original source of the review is Google. We employed 2 employees from Outsource Teams, The process was easy and response time was 2nd to non, Best experience so far. if your a looking on finding quality people that is cost efficient also look no further. Great for new start up company's looking to find quality and hardworking people.Posted onTrustindex verifies that the original source of the review is Google. I recently reached out to Richard for help expanding my ecommerce store. He supplied 2 staff who have been excellent! I highly recommend Outsource Teams and would be happy to use their services in future.Posted onTrustindex verifies that the original source of the review is Google. We reached out to ScaleUp Teams on a friend’s recommendation when we needed customer support agents. From our very first inquiry, their communication was prompt, clear, and supportive. They kept us in the loop at every stage. The first hire wasn’t the right fit, but they covered our first two weeks at no charge and provided a free replacement who turned out to be exactly what we needed. The process was truly risk-free! We absolutely recommend ScaleUp Teams!Posted onTrustindex verifies that the original source of the review is Google. We used ScaleUp Teams to hire a VA, media buyer and a designer. Their performance has been outstanding, helping us cut our staffing costs by more than 3× compared to local hires and scale much earlier than we thought possible. We’ll definitely be adding more team members through them.

Our accounting virtual assistants handle bookkeeping tasks, invWhyoicing, reporting, client communications, and appointment scheduling. They manage payroll, accounts payable/receivable, and financial reporting, so you stay focused on your clients.

At Outsource Teams, we provide top 1% vetted VAs from the Philippines, proficient in Xero, QuickBooks, and MYOB. Our free two-week trial lets you test risk-free, and our no-downtime guarantee means you only pay for productive hours. Whether it’s managing reports, reconciling accounts, or handling admin, we’ve got you covered.

Everything you need to know about hiring and working with accounting VAs

An accounting virtual assistant takes care of essential financial and administrative tasks, so you don’t have to. They handle bookkeeping, invoicing, payroll, accounts payable/receivable, financial reporting, and client communications.

Skilled in tools like Xero, QuickBooks, and MYOB, they ensure accuracy and efficiency while freeing you up to focus on high-level strategy and client relationships.

An accounting virtual assistant provides expert support across key financial functions, including:

With an accounting VA, you get skilled, reliable financial support—so you can focus on growing your business.

An accounting virtual assistant gives you skilled financial support without the overhead of hiring in-house. Here’s how they help:

An accounting VA helps you reduce costs, improve efficiency, and stay focused on what matters—your clients and business growth.

Finding the right accounting virtual assistant starts with experience. Look for VAs with a background in accounting or bookkeeping who understand financial processes. They should be proficient in accounting software like Xero, QuickBooks, and MYOB to integrate seamlessly into your workflow.

Communication skills is also key—your VA should be able to clearly relay financial data and collaborate effectively. Reliability matters too. Choose someone who meets deadlines, maintains strict confidentiality, and ensures accurate tax preparation and reporting.

At ScaleUp Teams, we provide only the top 1% of vetted VAs, ensuring you get a skilled, dependable assistant who fits your needs.

We offer flexible and affordable pricing plans to suit your business needs:

Both plans include:

You can save up to 70% on staffing costs, making it a more cost-effective option compared to hiring locally.

We hire the top 1% of virtual assistants in the Philippines through rigorous screening, including skills assessments, background checks, and interviews. VAs receive ongoing training, monthly performance reviews, and hourly timesheet tracking to ensure consistent quality and productivity.

If a VA doesn’t meet expectations during the free two-week trial period, we’ll provide a replacement at no extra cost, ensuring you get the right fit for your business—risk-free.

Scale your business faster with our vetted assistants from the Philippines. Start your free one week trial today and experience the difference.